Company News

1Q11 Revenues Up 77.0% Year-Over-Year to RMB171.7 Million

1Q11 Revenues Up Sequentially By 8.5%

Live Conference Call to be Held at 8:00 AM U.S. Eastern Time, June 23

BEIJING, June 22, 2011 /PRNewswire via COMTEX/ --

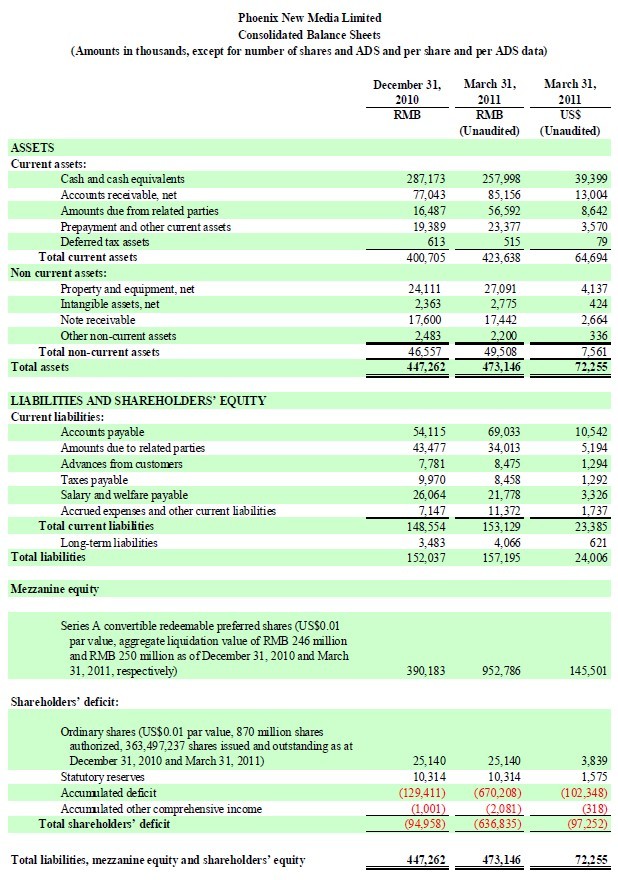

Phoenix New Media Limited (NYSE: FENG), a leading new media company in China ("Phoenix New Media", "PNM" or the "Company"), today announced its unaudited financial results for the first quarter ended March 31, 2011.

First Quarter 2011 Highlights

-

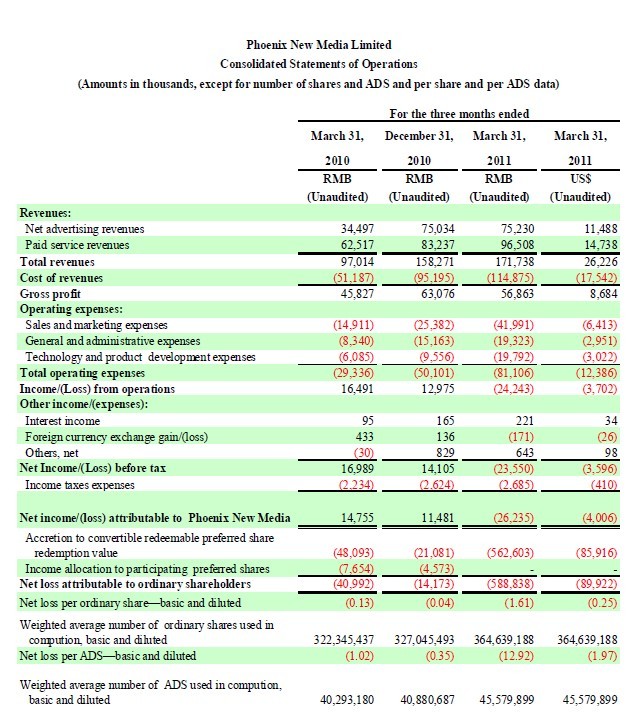

Total revenues increased by 77.0% to RMB171.7 million (US$26.2 million) from RMB97.0 million in the first quarter of 2010. The increase was driven by a 118.1% increase in net advertising revenues and a 54.4% increase in paid service revenues on a year-over-year basis. Both net advertising revenues and paid service revenues also increased on a sequential basis.

-

Gross profit increased by 24.1% to RMB56.9 million (US$8.7 million) from RMB45.8 million in the first quarter of 2010.

-

Non-GAAP adjusted net income attributable to Phoenix New Media increased by 24.9% to RMB21.8 million (US$3.3 million) in the first quarter of 2011 from RMB17.5 million in the first quarter of 2010, and increased by 18.5% from RMB18.4 million in the fourth quarter of 2010.

Mr. Shuang Liu, Chief Executive Officer, stated, "We are very excited to announce strong first quarter 2011 financial results in both our advertising and paid services segments. Although the first quarter is typically the weakest quarter for advertising due to the seasonal effect of the Chinese holidays, we have continued to deliver sequential growth for net advertising revenues for nine consecutive quarters.

"According to iResearch, from December 2010 to March 2011 we continued to register strong growth in average daily unique visitors and monthly unique visitors of 24% and 23%, respectively. By continuing to enrich our content offerings across verticals like entertainment, fashion, auto and finance, as well as for our video platform, we continued to attract more visitors and garner greater traction with these visitors.

"In addition to leveraging our core strength in our content-driven online media platform, we remain dedicated to expanding our mobile media applications for smart phones and tablets, while also enhancing and improving our interactive features. We believe that our continued innovation will keep us at the forefront of optimizing our user experience while creating a more seamless interface between all of our destinations regardless of when, where or how users choose to view their desired content."

First Quarter 2011 Financial Results

REVENUES

Total revenues increased by 77.0% to RMB171.7 million (US$26.2 million) in the first quarter of 2011 from RMB97.0 million in the first quarter of 2010.

Net advertising revenues increased by 118.1% to RMB75.2 million (US$11.5 million) in the first quarter of 2011 from RMB34.5 million in the first quarter of 2010. Net advertising revenues also increased from RMB75.0 million in the fourth quarter of 2010 despite the first quarter being a seasonally weak quarter. The increase in net advertising revenues was primarily due to an increase in the number of advertisers, which grew to 231 in the first quarter of 2011 from 137 in the first quarter of 2010, as well as growth in average revenues per advertiser ("ARPA"), which increased to RMB0.33 million (US$0.05million) in the first quarter of 2011 from RMB0.25 million in the first quarter of 2010. Net advertising revenues are recognized net of advertising agency service fees.

Paid service revenues increased by 54.4% to RMB96.5 million (US$14.7 million) in the first quarter of 2011 from RMB62.5 million in the first quarter of 2010, and increased by 15.9% as compared to the fourth quarter of 2010 of RMB83.2 million. The increase in paid service revenues was primarily due to the growth in wireless value added service ("WVAS") revenues, which increased to RMB63.4 million (US$9.6million) in the first quarter of 2011 from RMB35.8 million in the first quarter of 2010, as a result of increased business volume. Revenues from video VAS increased to RMB8.9 million (US$1.4 million) in the first quarter of 2011 from RMB2.8 million in the first quarter of 2010, primarily as a result of an increase in the number of purchasers of both per-view-based and subscription-based mobile video services.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues increased to RMB114.9 million (US$17.5 million) in the first quarter of 2011from RMB51.2 million in the first quarter of 2010. The increase was primarily due to an increase in WVAS revenues, which led to an increase in revenue sharing fees paid to telecom operators and channel partners, amounting to RMB52.9 million (US$8.0 million) in the first quarter of 2011, up from RMB24.0 million in the first quarter of 2010. The increase in cost of revenues also reflects the higher content and operational costs in the first quarter of 2011 of RMB44.7 million (US$6.8 million), which represents an increase from RMB17.7 million in the first quarter of 2010, primarily reflecting increased share-based compensation expenses associated with content production and advertising sales support staff.

For the first quarter of 2011, gross profit increased by 24.1% to RMB56.9 million (US$8.7 million) from RMB45.8 million in the first quarter of 2010. Gross margin was 33.1% in the first quarter of 2011 compared with 47.2% in the first quarter of 2010. The decline in gross margin resulted primarily from the significant increase in share-based compensation expenses and an increase in the revenue sharing fees associated with the WVAS business. Excluding the impact of share-based compensation expenses, gross margins would have been 42.2% as compared to 47.4% in the first quarter of 2010, and a sequential improvement from 40.0% in the fourth quarter of 2010.

OPERATING EXPENSES

Total operating expenses were RMB81.1 million (US$12.4 million) in the first quarter of 2011 as compared with RMB29.3 million in the first quarter of 2010. The increase was primarily attributable to increases in sales and marketing expenses, general and administration expenses and technology and product development expenses, which were primarily attributable to increases in staff costs due mainly to increases in share-based compensation expenses and in the number of personnel.

Total share-based compensation expenses, which are included in cost of revenues and operating expenses, increased to RMB48.0 million (US$7.3 million) as compared to RMB2.7 million in the first quarter of 2010. The significant increase in share-based compensation expenses was due to the grant of restricted shares and restricted share units to certain employees in March 2011.

NET INCOME/LOSS

Net loss attributable to Phoenix New Media was RMB26.2 million (US$4.0 million) in the first quarter of 2011, as compared to net income attributable to Phoenix New Media of RMB14.8 million in the first quarter of 2010.

Net loss attributable to ordinary shareholders was RMB588.8 million (US$89.9 million) in the first quarter of 2011, as compared to a net loss attributable to ordinary shareholders of RMB41.0 million in the first quarter of 2010. The increase in net loss attributable to ordinary shareholders was primarily attributable to an increase in accretion to Series A redeemable convertible preferred shares redemption value of RMB562.6 million (US$85.9 million) in the first quarter of 2011 as compared with RMB48.1 million in the first quarter of 2010 as a result of an increase in the fair value of ordinary shares. Diluted net loss per ADS (1) in the first quarter of 2011 was RMB12.92(US$1.97) as compared with RMB1.02 in the first quarter of 2010. The accretion to Series A redeemable convertible preferred shares redemption value and income allocation expense to participating preferred shares were non-recurring charges related to the preferred shares which were automatically converted to ordinary shares upon the completion of our initial public offering on May 17, 2011.

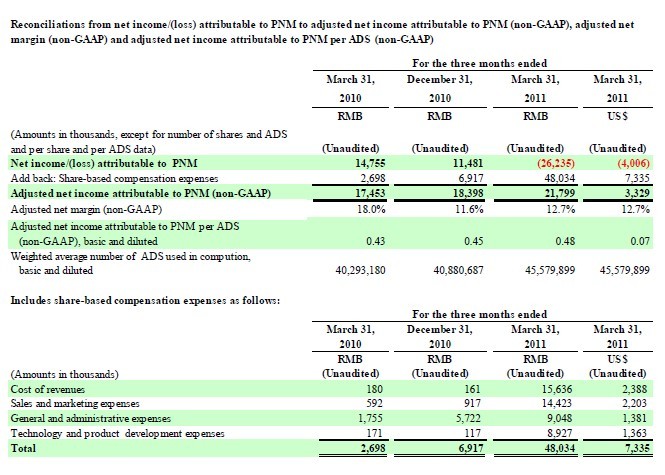

Adjusted net income attributable to Phoenix New Media (non-GAAP), which excludes share-based compensation expenses, increased by 24.9% to RMB21.8 million (US$3.3 million) in the first quarter of 2011 from RMB17.5 million in the first quarter of 2010. Adjusted net margin (non-GAAP) was 12.7% in the first quarter of 2011 as compared to 11.6% in the fourth quarter of 2010 and 18.0% in the first quarter of 2010. Adjusted net income attributable to Phoenix New Media per diluted ADS (non-GAAP) was RMB0.48(US$0.07) in the first quarter of 2011, which increased by 10.4% as compared to RMB0.43 in the first quarter of 2010.

An explanation of the Company's non-GAAP financial measures is included in the section entitled "Use of Non-GAAP Financial Measures" below, and the related reconciliations to GAAP financial measures are presented in the accompanying financial statements.

Business Outlook

For the second quarter of 2011, the Company expects its net advertising revenues to be between RMB110 million to RMB112 million, which represents growth of approximately 142% to 146% from the second quarter of 2010, and 46% to 49% growth, approximately, sequentially compared to this first quarter.

Paid service revenues are expected to be between RMB106 million to RMB109 million, which represents 35% to 39% growth, approximately, from the second quarter of 2010, and 10% to 13% growth, approximately, sequentially compared to this first quarter.

As a result, total revenues are expected to be between RMB216 million to RMB221 million, which represents 74% to 78% growth, approximately, from the second quarter of 2010, and 26% to 29% growth, approximately, sequentially from this first quarter. These forecasts reflect the Company's current and preliminary view on the market and operational conditions, which may be subject to change.

Recent Developments

The Company successfully completed its initial public offering and listing of 12,767,500 ADSs on the New York Stock Exchange on May 12, 2011. The underwriters of the initial public offering subsequently exercised their over-allotment option to purchase an additional 1,915,125 ADSs on June 8, 2011. The Company raised net proceeds of US$137.2 million from the offering. The Company's estimated expenses in connection with the offering were US$4.0 million.

Upon the completion of the initial public offering, all of the Company's outstanding convertible redeemable preferred shares were automatically converted into ordinary shares. In addition, immediately prior to the completion of the initial public offering, all of the Company's ordinary shares held by Phoenix Satellite Television (BVI) Holding Limited were re-designated as Class B ordinary shares and all of the Company's other outstanding ordinary shares, as well as its authorized but unissued ordinary shares, were re-designated as Class A ordinary shares. Each of the Company's Class B ordinary shares is entitled to 1.3 votes and each of the Class A ordinary shares is entitled to one vote on all matters subject to a shareholders' vote. Class B ordinary shares may be converted into Class A ordinary shares on a one-to-one basis, while Class A ordinary shares may not, under any circumstances, be converted into Class B ordinary shares. Apart from voting and conversion rights, the Company's Class A ordinary shares and Class B ordinary shares carry equal rights.

On May 18, 2011, the Company held its first video strategy press conference in Beijing. During the press conference, the Company launched its "Project Fengming", through which it plans to implement a differentiated video business strategy by establishing an online viewing, aggregation and distribution platform for news and information videos.

Conference Call Information

The Company will hold a conference call at 8:00 a.m. Eastern Time on June 23, 2011 (8:00 p.m.Beijing / Hong Kong time on June 23, 2011) to discuss its first quarter 2011 financial results and operating performance.

To participate in the call, please dial into one of the following telephone numbers below and use the participant passcode "ifeng" before the call starts:

|

U.S. Toll Free: |

1-800-573-4840 |

|

|

Hong Kong Toll Free: |

852-3002-1672 |

|

|

International Toll Free: |

1-617-224-4326 |

|

|

China: |

108008521490, |

|

|

108001202655, |

||

|

4008811629 (for mobile users) |

||

|

Participant passcode: |

ifeng (43364) |

|

A webcast of the conference call will be available through the Company's investor relations website at http://ir.ifeng.com/. Please go to the website at least fifteen minutes early to register or install any necessary audio software.

The replay of the call will be accessible through June 30, 2011 by dialing the following numbers:

|

U.S. Toll Free: |

1-888-286-8010 |

|

|

International: |

1-617-801-6888 |

|

|

Password: |

57686985 |

|

Use of Non-GAAP Financial Measures

To supplement the consolidated financial statements presented in accordance with the United States Generally Accepted Accounting Principles ("GAAP"), Phoenix New Media uses adjusted net income, gross margin excluding share-based compensation, adjusted net margin and adjusted net income per diluted ADS, each of which is a non-GAAP financial measure. Adjusted net income is net income/(loss) attributable to Phoenix New Media excluding share-based compensation expenses. Gross margin excluding share-based compensation expenses is gross profit with share-based compensation expenses added back, divided by total revenues; adjusted net margin is adjusted net income divided by total revenues; and adjusted net income per diluted ADS is adjusted net income divided by the weighted average diluted number of ADS. The Company believes that separate analysis and exclusion of the non-cash impact of share-based compensation adds clarity to the constituent parts of its performance. The Company reviews adjusted net income together with net income/(loss) to obtain a better understanding of its operating performance. It uses this non-GAAP financial measure for planning and forecasting and measuring results against the forecast. The Company believes that using several measures to evaluate its business allows both management and investors to assess the company's performance against its competitors and ultimately monitor its capacity to generate returns for its investors. The Company also believes that non-GAAP adjusted net income is useful supplemental information for investors and analysts to assess its operating performance without the effect of non-cash share-based compensation expenses, which have been and will continue to be significant recurring expenses in its business. However, the use of adjusted net income has material limitations as an analytical tool. One of the limitations of using non-GAAP adjusted net income is that it does not include all items that impact the Company's net income/(loss) for the period. In addition, because adjusted net income is not calculated in the same manner by all companies, it may not be comparable to other similar titled measures used by other companies. In light of the foregoing limitations, you should not consider adjusted net income in isolation from or as an alternative to net income/(loss) prepared in accordance with U.S. GAAP.

Exchange Rate

The reporting currency of the Company is Renminbi ("RMB") but, for the convenience of the reader, the amounts for the three months ended March 31, 2011 are presented in U.S. dollars ("USD"). Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB6.5483 to US$1.00, the noon buying rate in effect on March 31, 2011 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages are calculated using the numbers presented in the financial statements contained in this earnings release.

About Phoenix New Media Limited

Phoenix New Media Limited (NYSE: FENG) is the leading new media company providing premium content on an integrated platform across Internet, mobile and TV channels in China. Having originated from a leading global Chinese language TV network based in Hong Kong, Phoenix TV, PNM enables consumers to access professional news and other quality information and share user-generated content on the Internet and through their mobile devices. PNM's platform includes its ifeng.com channel, consisting of its ifeng.com website, its video channel, comprised of its dedicated video vertical and video services and applications, and its mobile channel, including its mobile Internet website and mobile Internet and value-added services ("MIVAS").

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Phoenix New Media's strategic and operational plans, contain forward-looking statements. Phoenix New Media may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission ("SEC") on Forms 20--F and 6--K in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Phoenix New Media's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company's goals and strategies; the Company's future business development, financial condition and results of operations; the expected growth of the online and mobile advertising, online video and mobile paid service markets in China; the Company's reliance on online advertising and MIVAS for the majority of its total revenues; the Company's expectations regarding demand for and market acceptance of its services; the Company's expectations regarding the retention and strengthening of its relationships with advertisers, partners and customers; fluctuations in the Company's quarterly operating results; the Company's plans to enhance its user experience, infrastructure and service offerings; the Company's reliance on mobile operators in China to provide most of its MIVAS; changes by mobile operators in China to the their policies for MIVAS; competition in its industry in China; and relevant government policies and regulations relating to the Company. Further information regarding these and other risks is included in its registration statement on Form F--1, as amended, filed with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Phoenix New Media does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

SOURCE Phoenix New Media Limited